In today’s rapidly evolving agricultural landscape, the fusion of technology and finance has sparked a revolution that is reshaping the way farmers cultivate and expand their businesses. At the forefront of this transformation stands Avenews, a pioneering agtech company based in Kenya (https://www.avenews-gt.com/) founded by Shalom Ben-or in 2017. With its innovative solutions and forward-thinking approach, Avenews is empowering farmers to not only optimize their operations but also secure the necessary financial resources for growth and sustainability.

The traditional challenges that farmers face in accessing finance have often hindered their ability to scale up their operations and seize new opportunities. However, the emergence of agtech solutions has paved the way for a more inclusive and efficient financial ecosystem within agriculture. Avenews, for instance, has harnessed the power of digital platforms to bridge the gap between farmers and financial institutions, allowing them to access financing (loans), money management tools and digital payments which helps them get more reach.

One of the key ways farmers can leverage agtech to finance and expand their businesses is through the integration of data-driven insights. Modern farming practices generate a wealth of data, from weather patterns and soil quality to crop yields and market trends. Agtech platforms like Avenews collect and analyze this data, enabling farmers to make informed decisions about their operations. These insights not only lead to improved productivity but also serve as valuable collateral when seeking financial support. Lenders are increasingly recognizing the value of data-backed business plans, making it easier for farmers to access loans and investment capital.

Moreover, the utilization of precision agriculture technologies has revolutionized resource allocation and management. Through tools such as remote sensing, GPS-guided machinery, and IoT devices, farmers can optimize the use of water, fertilizers, and pesticides. This not only reduces input costs but also minimizes environmental impact, a factor that is becoming increasingly important for both consumers and investors. The ability to demonstrate sustainable practices can open doors to impact investment and partnerships with companies that prioritize environmental stewardship.

Avenews’ success story exemplifies the potential of agtech and finance convergence. By providing farmers with access to financing, money management tools and digital payments, Avenews empowers them to make data-driven decisions that improve their market visibility and profitability. Furthermore, partnerships between agtech companies and financial institutions are creating tailored financial products that cater to the unique needs of the agricultural sector, such as flexible repayment schedules tied to harvest cycles.

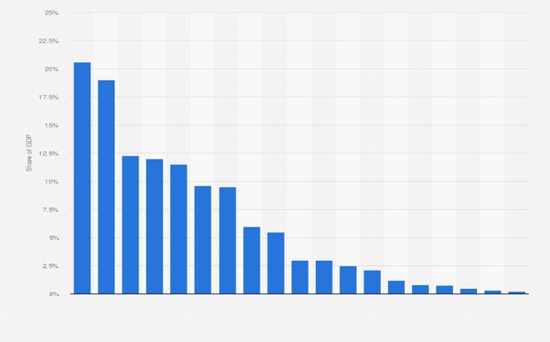

According to recent data, countries that have effectively harnessed agtech solutions have witnessed up to a 20% increase in agricultural productivity, leading to substantial contributions to their GDP growth. In Kenya, where Avenews operates, the agricultural sector constitutes a significant portion of the economy (33%GDP) according to the Food and Agriculture Organization of the United States, providing livelihoods for millions. The integration of agtech and finance has the potential to significantly augment this contribution.

In conclusion, the marriage of agtech and finance is reshaping the agricultural landscape, offering farmers unprecedented opportunities for growth and expansion. Through companies like Avenews, farmers are not only harnessing the power of technology to optimize their operations but are also gaining access to the financial tools needed to realize their expansion goals. As the synergy between agriculture, technology, and finance continues to deepen, the future holds the promise of a more resilient and prosperous agricultural sector, benefiting farmers, consumers, and economies alike.